Indicators for Conditions & Strategies

Indicators for Conditions & Strategies

Whether using indicators to identify overall bullish or bearish conditions or as setups and triggers for executing trades, it’s never a good idea to use only one as a “standalone” signal. Why? Individually, any signal is questionable. It doesn’t provide enough information or confirmation. But when 3-5 gatekeepers or thresholds are confirming the same thing, they add weight to the notion of a favorable or unfavorable market environment or probability for any particular strategy.

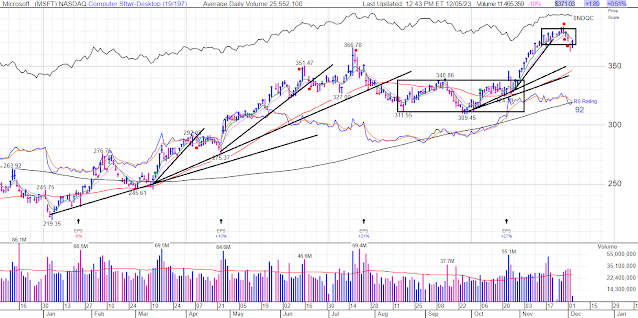

Instead, use a few different indicators and note how each one weighs the “evidence”. You don’t want them all to be momentum (moving averages, stochastics, relative strength, MACD, etc.). Instead of doubling up on indicators that roughly measure the same thing, intentionally assemble indicators that look at conditions from a variety of perspectives like momentum, volatility, trend, and volume.

It’s also important to have a variety or balance between leading (like stochastics, MACD, RSI) and lagging (like moving averages) indicators. It’s also never a good idea to use more than 3-5. Additionally, it’s imperative to decide on the hierarchy, meaning the order of importance and weight each indicator will be given because there may be times that indicators contradict each other or diverge. What then? How will you evaluate what action to take or not take? And how likely is it that all indicators will be flashing the same signals? Only at overbought or oversold conditions? Like everything with trading, there must be a plan. If “this” happens then I will do “that”.

Since all indicators are ultimately derivatives of price and volume action, your analysis can be streamlined by simply noting where and how price closes in addition to any other technical chart tools (drawings like trend lines and range boxes, and/ or indicators) you deem worthy of using to alert, predict, or confirm conditions, setups, and triggers.

Take the time to understand the indicators or head and tailwind proxies (like other markets and sectors, number of new highs or lows, or number of stocks above or below moving averages, equal weight vs. weighted indices) that comprise your analysis and what they seek to measure. Know what you’re using and specifically why. Otherwise you're unwittingly introducing additional distraction and risk into your trading.

%202023_12_05%20(9_32_05%20AM).png)

Comments

Post a Comment