Pullbacks & Discipline

Pullbacks & Discipline

On days when there are pullbacks do you start to worry? Does your discipline weaken? Do you find yourself starting to make emotional decisions and choke the trade? A simple question you can ask yourself is, "Has price closed above the 'X' EMA?"

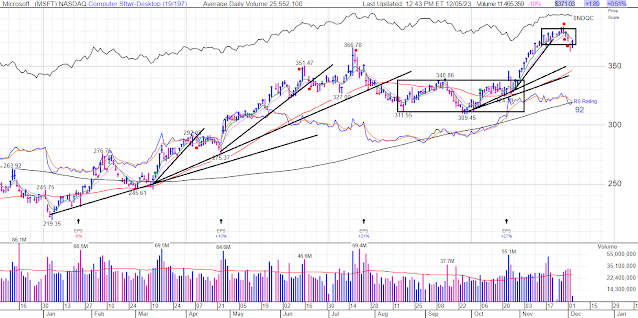

On the daily charts, Ilike to use the 5, 9, and 15 EMAs or the boss MA (the moving average containing the prior pullbacks). Or if a trend is just getting started, I may use the 20 EMA, 50 or 200 SMA as my landmark Why would I sell a stock on a pullback day when it is still closing above the 9 EMA? Why would I choke the trade when there's no obvious, quantifiable sign the trend has come to an end? Pullbacks are normal and natural in trending moves.

To begin, start with a moving average, then expand your gaze to various trendlines, then glance at prior swing highs or lows. Have a repeatable plan that clearly defines ‘when’ you will scale out and ‘where’, and ‘when’ you will be all out and ‘why’. What will your specific triggers be? Consider taking profits incrementally. There are offensive exits where you can lock in partial gains like after a gap rips higher, you identify a blow off top or the run is so parabolic it’s excessively stretched from a moving average. There are defensive exits where you can shave off profits, like if price closes below a certain moving average or swing high or low.

When a trend line is further away some are fearful of potentially giving back “too much” profits and end up cutting their winners short! But there are also short-, medium- and longer-term trend lines established in many trending moves. You can establish set guidelines that scales out a certain percentage of one’s position as price falls below each one. Any or a combination of all these can be practiced regularly and then reevaluated or finetuned during post analysis.

Understanding how to frame price action in “context” is essential to keeping your emotions under control and your strategy in the driver's seat. So, on a down day, before you ruin a perfectly good trade by exiting or making your stops ridiculously tight, compare price to a few relative reference points on the chart and refer to your trading plan where you’ve clearly spelled out where, why and how you will exit.

%202023_12_05%20(9_32_05%20AM).png)

Comments

Post a Comment